The private capital industry rolled into Singapore last week for Super Return Asia. The conference is a key moment in the calendar for international firms to meet in person with their Asian investors, check up on regional portfolio interests, and importantly for everyone to take the global pulse from an Asia perspective.

It’s a more sedate gathering than its international sibling held in Berlin, so sadly I cannot reveal any live performances former Spice Girls or popular mid-2000s Indie bands. Nonetheless, Singapore’s incredible bayfront provided ample rooftop venues for some conversations with LPs, GPs, and other consultancies focused on alternatives.

Here are some takeaways…

- Tariffs are not the big deal I expected them to be. Far from obsessing about the implications for investments and portfolio companies in the APAC region, most see opportunity for savvy operators. It’s a chance to refocus portfolios and companies on exciting cross border, regional investments, and across both the consumption and production sides.

Of course, this sort of supply chain change – what some call Globalisation 2.0 – comes with new risks. But, with the right partners who have on the ground experience navigating a fragmented region, the result could be more stability and growth than before.

- Private credit is surprisingly nascent in Asia. The reality is banks are still doing most of regional lending activity, which in the US or Europe is increasingly being picked up by private credit. Part of the reason is relationship driven but another is a banking sector that didn’t undergo the same level of regulatory disruption post global financial crisis.

- India’s presence in private capital is increasing – and most of these GPs are looking East, not West, for growth and new opportunities. The country’s equity capital markets are buoyant, with financial inclusion improving and more retail investors getting savvy to their investment opportunities in private markets.

In a country still dominated by the banks for lending, but one that also has around $70bn of retail investor cash annually looking for a home, it’s likely that money will underpin the growth of private credit, both in India and into Indian VCs looking to the rest of Asia for better returns.

- Sustainability and impact investing is far from dead in Asia. Given the continent’s immense diversity of natural environment and socio-economic backgrounds, combined with the mega trend towards the energy transition, there are abundant opportunities for focused impact led strategies.

Sentiment in the US (and to an extent in Europe) is subdued under the current Administration, so these impact funds are now looking to target both local, Asian capital and targeted European capital for their fundraising, rather than the US.

By coincidence, last week Australia also launched its first ever climate risk assessment for the country, committing to spend $6 billion towards climate change mitigation by 2030.

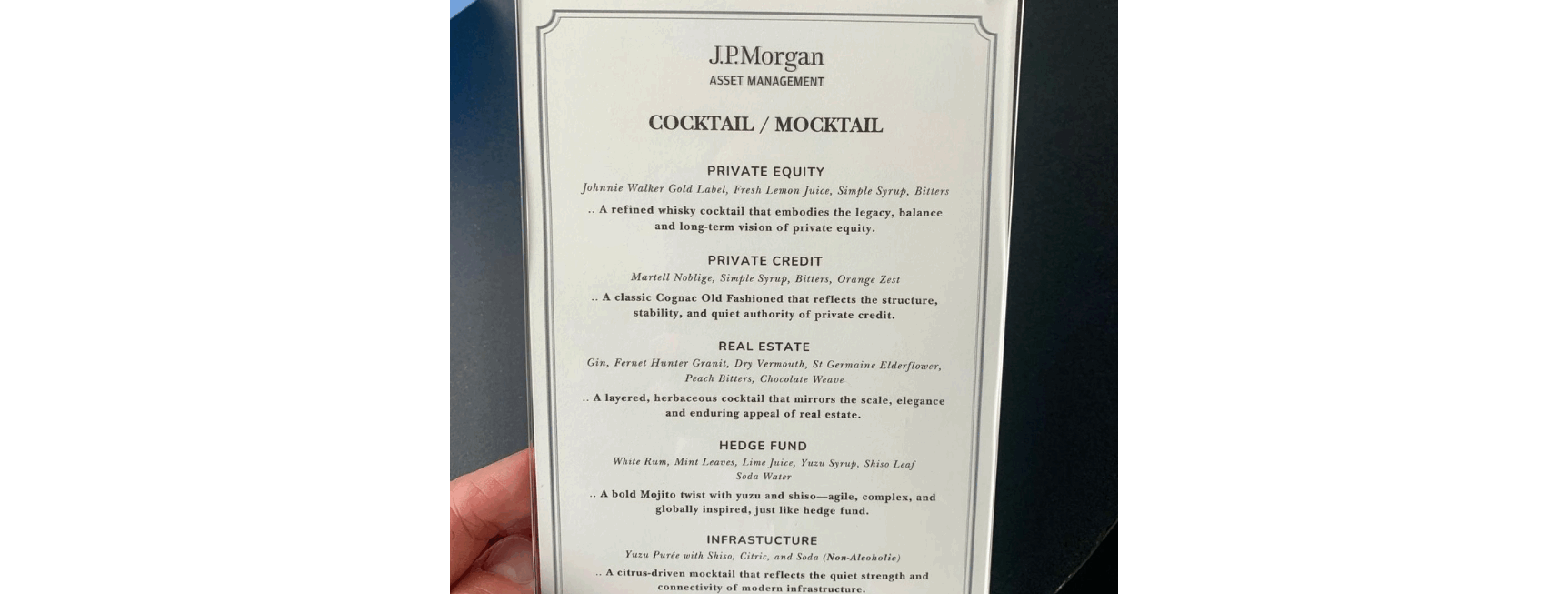

- Who says marketing can’t be fun and creative in the investment space? JP Morgan Alternative’s events team wins the prize for smartest idea for their evening drinks gathering at the National Gallery. See photo. What would you pick?