Latest insights

-

Transformation & Change | 12 Jun 2025

Insights from the CIPD Festival of Work 2025

-

09 Jun 2025

Credit, Europe and Sporty Spice take centre stage at SuperReturn

-

08 Jun 2025

08 Jun 2025M&A integration and communication: The importance of Day One and how to get it right

-

23 May 2025

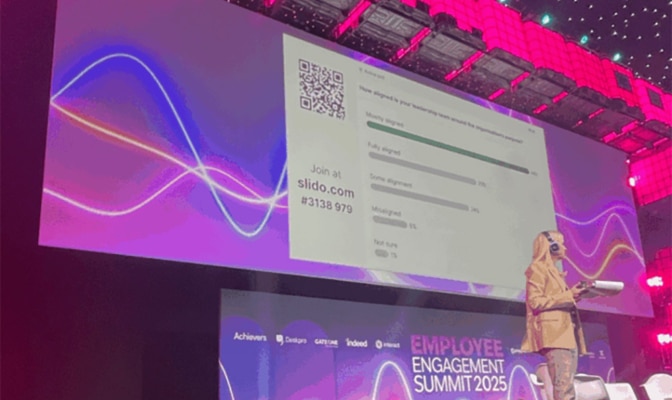

23 May 2025Insights from the Employee Engagement Summit 2025

-

22 May 2025

22 May 2025Bridging internal and external communications to build trust from the inside out

-

14 May 2025

14 May 2025It starts from within: how corporate culture drives reputation & results

-

10 May 2025

10 May 2025How listening inside and out can transform employee communications

-

01 May 2025

01 May 2025Analysis: Marks & Spencer’s response to cyber-attack

-

10 Apr 2025

10 Apr 2025Takeovers: what I wish I’d known